Smarter Leasing To Drive Your Small Business Forward

- Experience You Can Trust

- Tailored For Small Business

- Tax Savings

- Simple, Supported Process

Electric Vehicles: Smart For Your wallet. Smarter For The Planet.

Start Exploring Your Leasing Options

Find out what you could save

Important Update: changes to PHEVs from April 2025

From 1 April 2025, plug-in hybrid vehicles (PHEVs) will no longer be considered zero- or low-emissions vehicles under the FBT exemption. However, fully electric vehicles (EVs) will continue to qualify until 30 June 2027.

If you’re considering a PHEV, now’s the time to act. Vehicles leased before April 2025 will retain their FBT exemption for the life of the lease – so you can lock in the benefit now and continue to save.

Why Lease An EV Through SupaLease?

With over 23 years of experience in vehicle leasing and fleet solutions, we understand the needs of small businesses. Our process is designed to be simple, supportive and stress-free from day one to lease return. If you’re eligible, electric vehicles (EVs) and plug-in hybrid electric vehicles (PHEVs)* are 100% exempt from FBT when packaged through a Novated Lease, meaning you can pay for the car and running costs using your pre-tax income. That’s a serious saving over traditional car financing.

Not only are you reducing your carbon footprint, but you’re also taking home more of your salary.

The benefits of leasing an EV through SupaLease

No Fringe Benefits Tax (FBT)

Save thousands thanks to the government’s EV tax incentive

Pre-tax salary deductions

Pay for your lease and running costs using pre-tax income

Instant savings

Lower upfront and ongoing costs compared to buying outright or traditional finance

Eco-friendly

Reduce your carbon emissions and contribute to a cleaner future

Simple running costs

Electricity is often cheaper than petrol, and EVs have fewer moving parts to maintain

Tailored support

Our team guides you every step of the way with personalised, fuss-free service

Lock in savings

Secure the FBT exemption for the life of your lease when you act before key cut-off dates

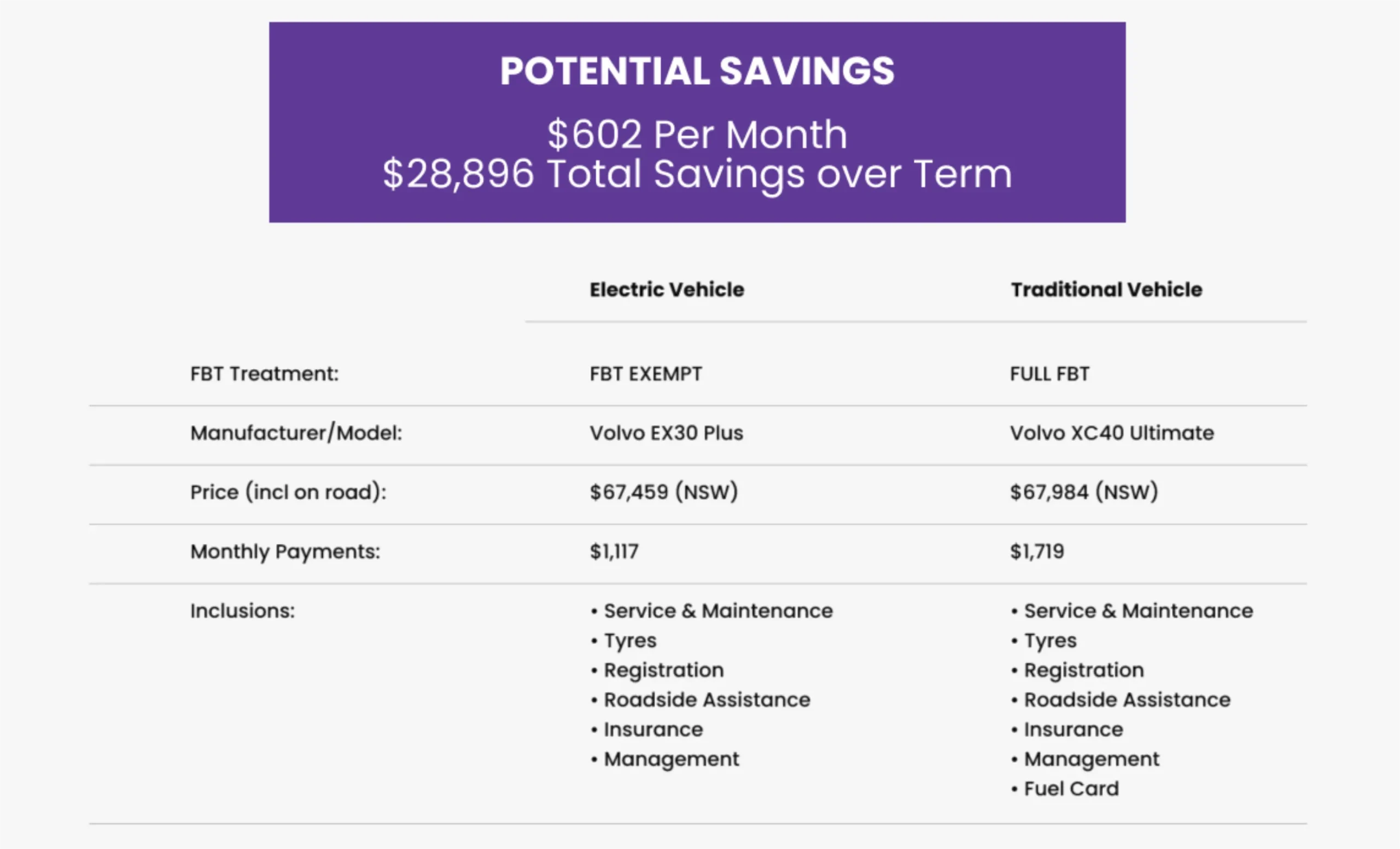

Example: How much could you save with an EV Novated Lease

Indicative calculations based on a Novated Lease over a 4 year term with 38% balloon. Annual employee salary based in NSW is based on $135k with an estimated 12,580 km pa. Monthly repayments represent the amount the employee’s monthly salary will be reduced each month to pay for the Novated Lease. Inclusions: service, maintenance, tyres, rego, roadside, insurance, management and fuel (if required). Vehicle prices are subject to change but calculations are accurate as at 27/08/24.

Frequently Asked Questions

What types of electric vehicles are eligible for the FBT exemption?

How long does the FBT exemption last?

How much could I save by leasing an EV?

Is it better to lease or buy an EV?

What’s included in a novated lease for an EV?

– Vehicle finance

– Charging and electricity costs

– Insurance

– Registration and servicing

– Tyres and roadside assistance

That means no surprise bills and less admin for you.

Find the right lease for your business

- Or call us on

- 1300 NOVATE