Smarter Leasing To Drive Your Small Business Forward

- Experience You Can Trust

- Tailored For Small Business

- Tax Savings

- Simple, Supported Process

What is a Novated Lease?

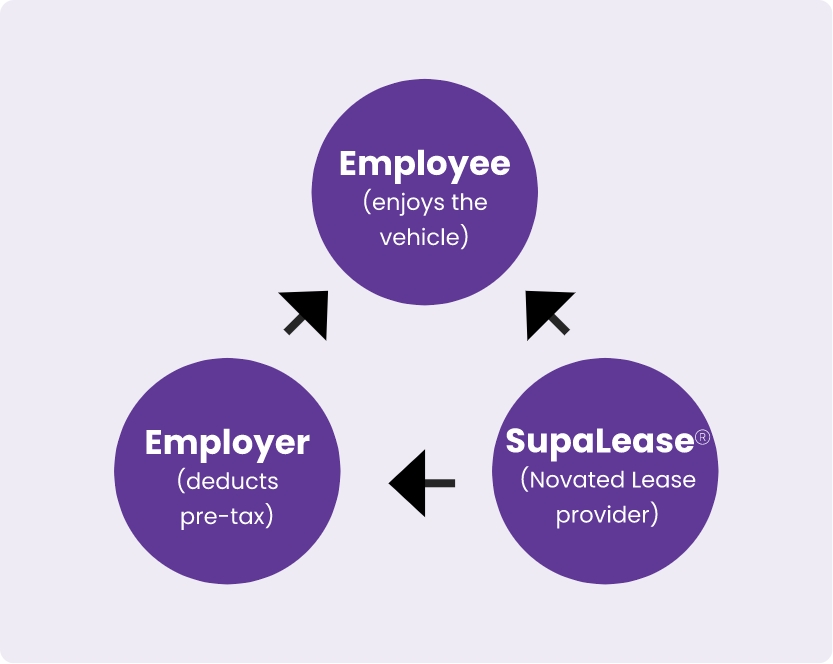

A novated lease is a smart, tax-effective way to lease a car if you’re a PAYG employee. It’s a three-way agreement between you, your employer, and SupaLease, letting you lease a car using your pre-tax income – which means no GST on the purchase price and thousands saved upfront.

You can also bundle running costs like fuel, rego, insurance and servicing into one simple payment, all managed by SupaLease.

Curious what you could save?

Start Exploring Your Leasing Options

Keen for more information?

How does a novated lease work?

We work with you and your employer to calculate a tailored pre-tax deduction that covers all vehicle running costs. Whether it’s fuel, servicing or insurance, you use a SupaLease card to pay, and we deduct it from your salary package. It’s that simple.

Your lease can be fully customised to suit your lifestyle and budget, with options including EV novated leases, flexible payment terms, and no deposit requirements.

Why Choose SupaLease?

With over 23 years of experience in car leasing and fleet management, SupaLease is a trusted partner for thousands of Australians. We specialise in small business leasing solutions, offering affordable, flexible, and easy-to-manage vehicle finance.

Your novated lease can bundle all running costs – from tyres, fuel, roadside assistance, rego and more – into one streamlined payment, fully managed by SupaLease. No admin, no stress.

Tyres

Fuel Card

FBT Reporting

Roadside Assist

Toll

Management

Registration

Management

Accident & Claims Management

Infringement Management

Whether you’re after a novated lease in Melbourne, Brisbane, Sydney, Adelaide or Perth, we’re here to support you every step of the way.

Frequently Asked Questions

What are the benefits of a novated lease?

How does a novated lease work in Australia?

Can I lease an electric vehicle through a novated lease?

Is a novated lease better than a car loan?

Can I get a novated lease if I work for a small business?

NOT SURE WHERE TO START?

- Or call us on

- 1300 NOVATE